The average financial literacy performance of Estonian students is higher than that in every other participating country or economy in the 2018 PISA financial literacy tests, the Organisation for Economic Co-operation and Development announced.

The PISA 2018 assessment of financial literacy – the results of which were published on 7 May 2020 – among 15-year-old students was the third of its kind. It assesses the extent to which students have the knowledge and skills, acquired both in and outside of school, that are essential for making financial decisions and plans for their future.

Around 117,000 students were assessed in financial literacy in the 2018 test, representing about 13.5 million 15-year-olds in the schools of the thirteen OECD countries, including Estonia, and seven partner countries, OECD, the organiser of the tests, said. The 2018 financial literacy assessment consisted of a one-hour, computer-based test using items drawn from a set of 43 question items.

The assessment addressed topics such as dealing with bank accounts and debit cards, understanding interest rates on a loan, or choosing between a variety of mobile phone plans. Only one in ten students performs at the highest level of financial literacy, on average; these students are able to make financial decisions in contexts that will only become relevant to them later in life, OECD said.

Financial literacy integrated into studies in Estonia

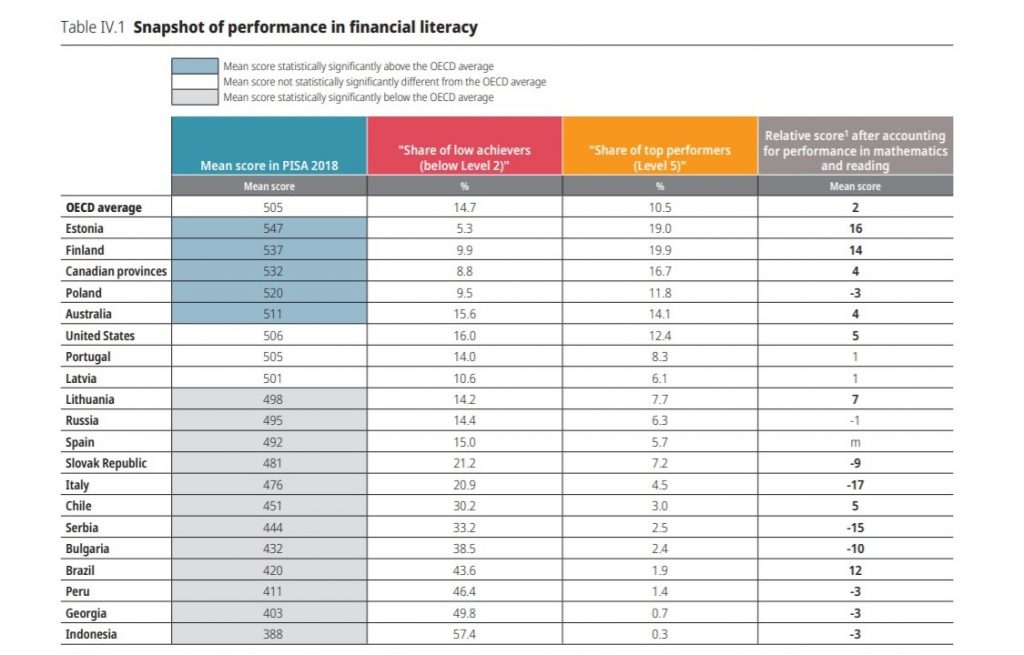

According to the test, the average financial literacy performance in Estonia was higher than that in every other participating country or economy, followed by performance in Finland and the Canadian provinces.

The OECD highlighted that “since 2010, financial literacy has been integrated into civics studies for junior high and high school students in Estonia. Financial literacy is also a component of economics and entrepreneurship studies, an optional subject.” However, the organisation added that “the Estonian education system provides teachers with a large degree of autonomy as to how and what to teach; hence, financial education may differ widely from school to school”.

The OECD also highlighted in the lengthy report that “March has been designated as Financial Literacy Month in Estonia”. “For the past seven years, the Estonian Banking Association and its partners have provided school classes for junior high and high school students. Students can also take part in the ‘Estonian Money Quiz’ and other money Olympiads. The Bank of Estonia operates a museum with exhibitions about the invention of money, various monetary systems throughout Estonian history, how to spot counterfeit money, and the impact of interest rates on daily life,” the organisation said.

According to the Estonian education ministry, 5,371 students in Estonia participated in the test – 75 per cent of whom took the test in Estonian and 25 per cent in Russian.

The coronavirus impact makes financial literacy even more important

The OECD emphasised that the indirect impact of the COVID-19 crisis on individuals’ income and savings and heightened uncertainty in the economic and financial landscape make financial literacy even more crucial for ensuring that citizens are financially resilient.

“Many 15-year-olds face financial decisions and are already consumers of financial services. They are likely to face growing complexity and risks in the financial marketplace as they move into adulthood. Since better knowledge and understanding of financial concepts and risks could help improve financial decision making amongst adults and young people, financial literacy is now globally recognised as an essential life skill,” the OECD said.

Among other findings, the tests showed that:

- Boys scored a bit higher than girls in the PISA 2018 financial literacy assessment, on average across OECD countries or economies.

- Socio-economically advantaged students performed better in financial literacy than disadvantaged students.

- Confidence in using digital financial services was associated with stronger financial literacy performance. Students who reported being confident in keeping track of their balance online scored higher points.

- Parents, guardians and other adult relations were students’ most common source of information about money matters: 94% of students reported obtaining such information from their parents. Students who look to their parents as a source of information about money matters, outperformed students who do not do.

- Students who use the internet as a source of such information outperformed those who do not use the internet as a source of information; and students who obtain information about money matters from other sources (friends, television or radio, magazines or teachers) scored below students who do not obtain information about money matters from these sources.

- Roughly four in five students reported that they could decide independently what to spend their money on. These students scored higher in the financial literacy assessment than students who did not report so.

Financial literacy test optional for countries

PISA is a triennial survey of 15-year-old students around the world that assesses the extent to which they have acquired key knowledge and skills essential for full participation in social and economic life. The PISA 2018 survey – the main results of which were published on 3 December 2019 – focused on reading, with mathematics, science and global competence as minor areas of assessment.

The assessment of young people’s financial literacy was optional for countries and economies. The following countries/economies participated: Australia, Brazil, Bulgaria, Canadian provinces (British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island), Chile, Estonia, Finland, Georgia, Indonesia, Italy, Latvia, Lithuania, Peru, Poland, Portugal, the Russian Federation, Serbia, the Slovak Republic, Spain and the United States.

The Paris-based Organisation for Economic Co-operation and Development is an intergovernmental economic organisation with 37 member countries, founded in 1961 to stimulate economic progress and world trade. Estonia became a member of the OECD on 9 December 2010.

Cover: Students at an Estonian school. Photo by Aivo Kallas.