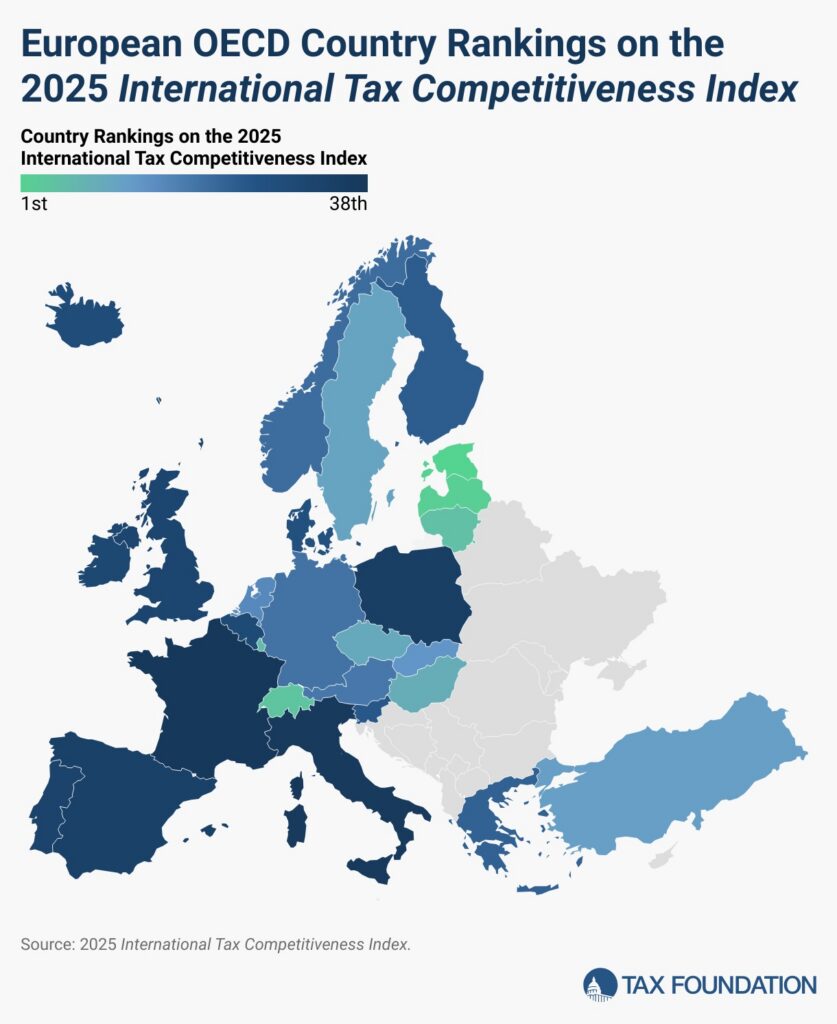

For the twelfth consecutive year, the Tax Foundation has ranked Estonia’s tax system as the most competitive among the countries of the Organisation for Economic Co-operation and Development.

According to the Tax Foundation, a Washington, DC-based think tank, Estonia’s top ranking is driven by four key features of its tax system.

“First, it has a 20 per cent corporate income tax that is only applied to distributed profits. Second, it levies a flat 20 per cent tax on individual income, which does not apply to personal dividend income. Third, its property tax is imposed solely on the value of land, rather than on the value of real property or capital. Finally, it operates a territorial tax system that exempts 100 per cent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions,” the foundation explained.

While Estonia’s tax system remains the most competitive in the OECD, other high-ranking countries achieve strong scores through excellence in one or more major tax categories.

A determining factor in a country’s economic performance

“Latvia, which recently adopted the Estonian system of corporate taxation, also has a relatively efficient system for taxing labour income. New Zealand operates a comparatively flat, low-rate individual income tax that largely exempts capital gains (with a combined top rate of 39 per cent), a broad-based VAT, and levies no taxes on inheritance, property transfers, assets or financial transactions.”

According to the think tank, the structure of a country’s tax code is a key determinant of its economic performance.

“A well-designed tax code is straightforward for taxpayers to comply with and can foster economic growth while generating sufficient revenue to meet the government’s priorities. By contrast, poorly designed tax systems can be costly, distort economic decision-making, and weaken domestic economies.”

The Tax Foundation further notes that a competitive tax code is one that keeps marginal tax rates low.

High taxes drive investment elsewhere

“In today’s globalised world, capital is highly mobile. Businesses can choose to invest in any number of countries across the globe to secure the highest return. This means they will naturally seek out jurisdictions with lower tax rates on investment to maximise their after-tax profits. When a country’s tax rates are too high, investment tends to move elsewhere, resulting in slower economic growth. Moreover, high marginal tax rates can discourage domestic investment and encourage tax avoidance.”

According to the think tank, the least competitive tax systems among OECD countries are found in France, Italy and Colombia.

The Organisation for Economic Co-operation and Development (OECD) is an intergovernmental organisation of 38 member countries, established in 1961 to promote economic progress and global trade. It serves as a forum for nations committed to democracy and the market economy, offering a platform to compare policy experiences, address shared challenges, identify best practices and coordinate both domestic and international policies.

The Tax Foundation is an American think tank based in Washington, DC. Founded in 1937 by a group of business leaders, it was created to “monitor the tax and spending policies of government agencies.”