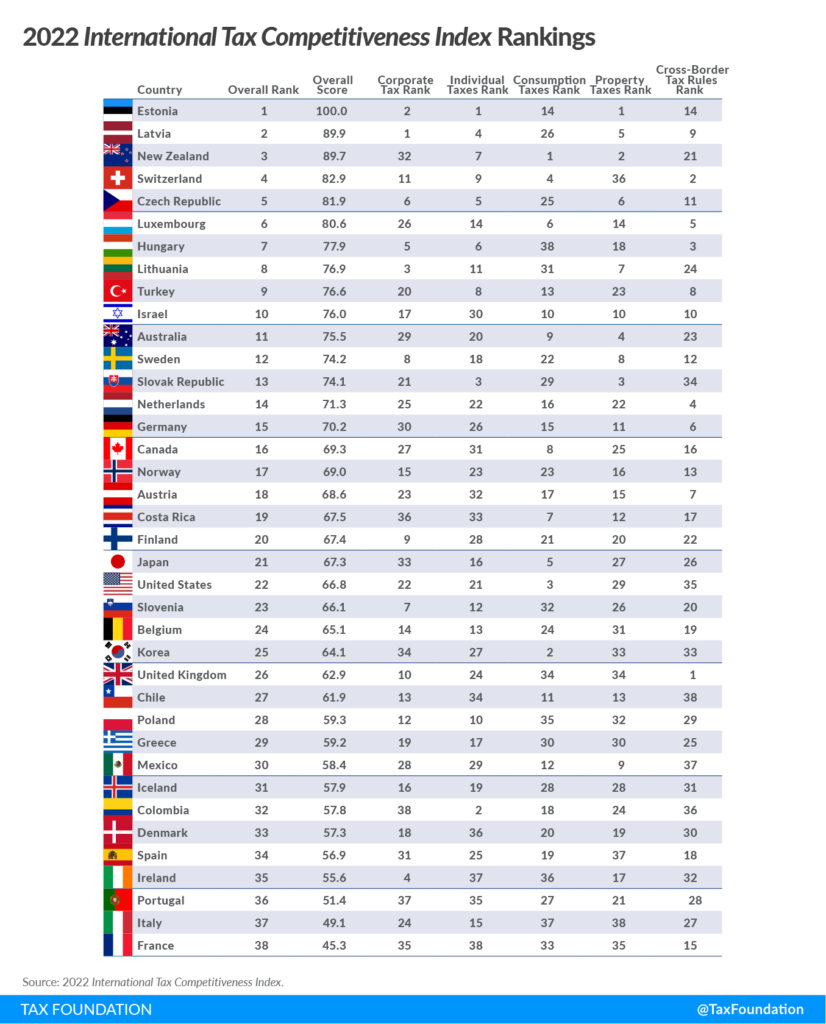

For the ninth year in a row, Estonia has the best tax code among the members of the Organisation for Economic Co-operation and Development – known as the OECD – according to the International Tax Competitiveness Index 2022, compiled by the Tax Foundation.

Estonia’s “top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits. Second, it has a flat 20 percent tax on individual income that does not apply to personal dividend income,” the report says.

“Third, its property tax applies only to the value of land, rather than to the value of real property or capital. Finally, it has a territorial tax system that exempts 100 percent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions.”

The report does highlight some of the weaknesses of the Estonian tax system. For example, Estonia has tax treaties with just 61 countries, below the OECD average, which is 74 countries.

“Estonia’s territorial tax system is limited to European countries,” the report lists as another weakness, adding that “Estonia’s thin capitalization rules are among the more stringent ones in the OECD”.

Latvia adopted Estonia’s corporate taxation system

According to the International Tax Competitiveness Index 2022, the other top countries’ tax systems receive high scores due to excellence in one or more of the major tax categories.

“Latvia, which recently adopted the Estonian system for corporate taxation, also has a relatively efficient system for taxing labor income,” the report points out. Latvia is ranked second in the 2022 index.

New Zealand has the third best tax code among the OECD members, Switzerland fourth and the Czech Republic fifth. Lithuania comes eighth, Sweden 12th and Finland 20th.

The International Tax Competitiveness Index seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality. It’s compiled by the Tax Foundation, an American think tank based in Washington, DC. It was founded in 1937 by a group of businessmen to “monitor the tax and spending policies of government agencies”.