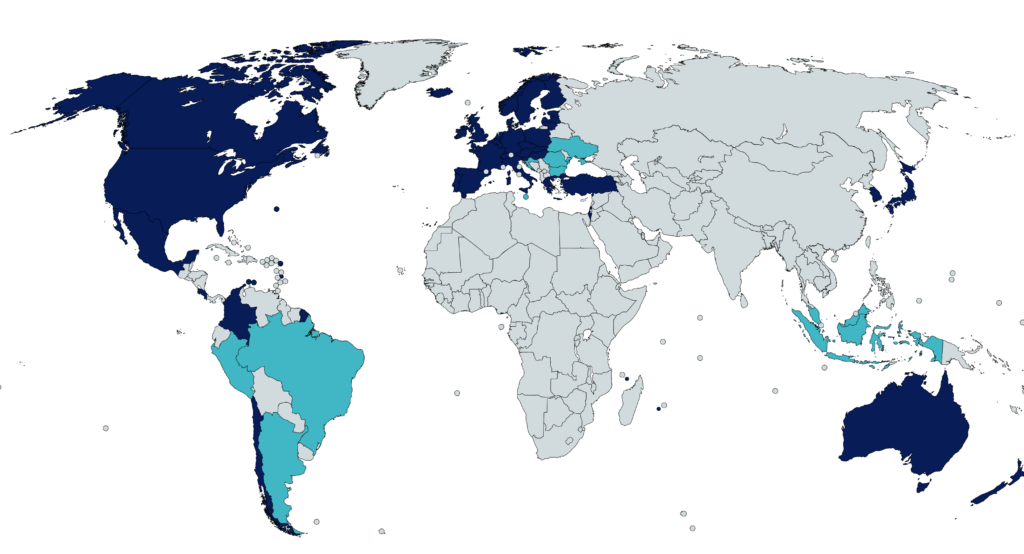

According to the Tax Foundation, an American think tank, Estonia has the sixth lowest top income tax rate in Europe and the second lowest among European OECD countries.

Of the European countries that are members of the Organisation for Economic Co-operation and Development (OECD), only Hungary has a lower top personal income tax rate of 15 per cent. Estonia comes second with a flat rate of 20 per cent, and the Czech Republic is third with 23 per cent.

“European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate. Bulgaria and Romania (10 per cent) levy the lowest rate, followed by Moldova (12 per cent), Ukraine (19.5 per cent) and Georgia (20 per cent),” the Tax Foundation said.

Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 per cent in 2024. Denmark (55.9 per cent), France (55.4 per cent) and Austria (55 per cent) have the highest top rates, the think tank said. There are no non-OECD countries among the highest-taxing European countries.

The top personal income tax rates in Europe in 2024:

| Country | Top personal income tax rate |

| Bulgaria | 10.0% |

| Romania | 10.0% |

| Moldova | 12.0% |

| Hungary | 15.0% |

| Ukraine | 19.5% |

| Estonia | 20.0% |

| Georgia | 20.0% |

| The Czech Republic | 23.0% |

| Slovakia | 25.0% |

| Latvia | 31.0% |

| Lithuania | 32.0% |

| Cyprus | 35.0% |

| Malta | 35.0% |

| Croatia | 35.4% |

| Poland | 36.0% |

| Switzerland | 39.5% |

| Norway | 39.6% |

| Turkey | 40.8% |

| The US state and federal average (for comparison) | 42.1% |

| Greece | 44.0% |

| The United Kingdom | 45.0% |

| Luxembourg | 45.8% |

| Iceland | 46.3% |

| Italy | 47.3% |

| Germany | 47.5% |

| Ireland | 48.0% |

| The Netherlands | 49.5% |

| Slovenia | 50.0% |

| Finland | 51.4% |

| Sweden | 52.3% |

| Portugal | 53.0% |

| Belgium | 53.5% |

| Spain | 54.0% |

| Austria | 55.0% |

| France | 55.4% |

| Denmark | 55.9% |

The Tax Foundation also says that some countries in Europe are considering changing their top personal income tax rates in the next few years.

“Austria is planning to eliminate its highest tax bracket in 2026, reducing its top income tax rate from 55 per cent to 50 per cent. Estonia is set to increase its flat income tax rate from 20 to 22 per cent in 2025.”

The Tax Foundation is an American think tank based in Washington, DC. It was founded in 1937 by a group of businessmen to “monitor the tax and spending policies of government agencies”.